For working nurses of all ages and experience levels - who want to retire with wealth and freedom

Most nurses have no idea whether their retirement Plan is healthy, at risk for injury, or circling the drain. This $27 course will give you the insight and strategy you need to retire with confidence.

Claim Your Printed copy of Millionaire Nurse Prescription™ wealth building course for $27

Goals and Objectives of The Millionaire Nurse Prescription™ Course and Personal Review

Read (or listen) to the Prescription and follow along with the printed workbook to build your nurse-specific (early) retirement plan.

Create or refine a clear, realistic roadmap using the tools, checklists, and step-by-step guidance built for nurses.

Use the workbook to organize income, taxes, accounts, timelines, and prepare for your Millionaire Nurse Prescription - Personalized Review. You can book this review after you purchase the course.

Get Started Here To gain Instant Digital Access

We’ll Ship the Printed Materials

$154 Value — Yours Today for Just $27

GET INSTANT ACCESS TO THE MILLIONAIRE NURSE PRESCRIPTION™

Here’s what you get when you get access today

When you enroll today, you’re not just getting a guide — you’re unlocking the complete nurse-specific retirement system: the Millionaire Nurse Prescription ebook, the printed Mastering Retirement book, the workbook, the audiobook, and the Pre-Retirement Checklist — all in plain English, all built for nurses, all designed to remove the guessing, the stress, and the overtime-dependency loop.

The Millionaire Nurse Prescription™ eBook and audio version ($29.97 Value)

This ebook gives nurses a clear and realistic path to financial freedom. Inside, you’ll learn why traditional retirement advice fails nurses, how the Personal Retirement Account works in plain English, and how to use the Protect–Grow–Access™ system to build wealth without relying on overtime or risking losses in the market. You’ll see exactly how nurses retire by 55, how much you truly need to save, how to build tax-free income, how to avoid the most common retirement mistakes, and how PRA loans allow your money to keep compounding even while you use it. This book is your lifelong, nurse-friendly roadmap for building calm, predictable, six- to seven-figure wealth—designed for your career, your schedule, and your future.

The Millionaire Nurse Prescription Personalized Review

Have your "Pete" moment. Sit down with one of our nurse-focused retirement advisors, review your accounts, and ensure you are optimized to grow and protected for the future. (Priceless)

94-Page Printed Book Shipped Directly To You ($19.97 Value)

Get the full Mastering Retirement blueprint in a beautifully designed, easy-to-follow printed book — built for nurses. Highlight key insights, jot down notes, and keep it on hand as a lifelong retirement reference.

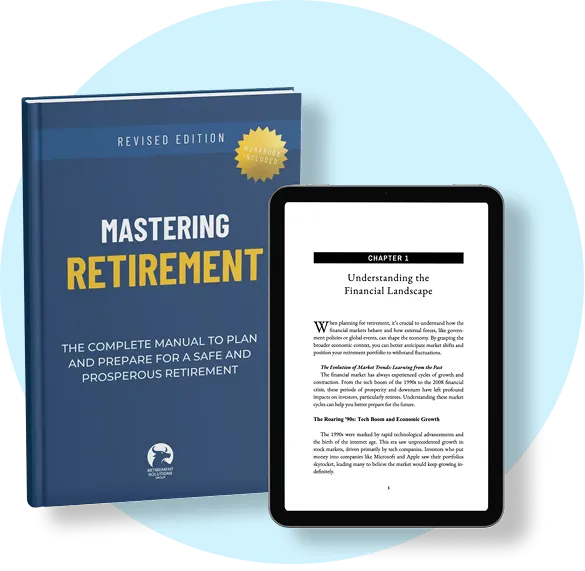

Instant Access to the Digital Versions (EPUB, APPLE, KINDLE, MOBI) – $19.97 Value

Prefer reading on your tablet or phone? You’ll get immediate access to every major digital format, so you can dive in from any device — anytime, anywhere.

Instant Access to the professionally narrated audio version of the book - $19.97 Value

Prefer reading on your tablet or phone? You’ll get immediate access to every major digital format so you can dive in from any device — anytime, anywhere.

34-page printed workbook ($47 Value)

Organize EVERYTHING — income, taxes, accounts, timelines, and goals — with the printed workbook built specifically for nurses. It’s your roadmap: structured, written, and ready to execute.

BONUS: The Pre-Retirement Checklist - The 11-step financial checklist your ($47 Value)

Get the nurse-specific 11-step checklist that helps you avoid the biggest retirement mistakes nurses make. Built on the same core framework, this printable guide shows you the critical steps most nurses miss — until it’s too late.

$154 Total Value for only $27 Today

Optional Upgrade #1 - The Annuity Blackbook

Most financial advisors won’t tell you the whole truth about annuities, but this book will.

Add The Annuity Blackbook Bundle– Unlock the Insider Secrets to Annuities That Advisors Don’t Want You to Know. The Annuity Blackbook reveals hidden fees, advisor commissions, and strategies to help you maximize your income and protect your retirement savings.

The best and worst annuities — and which ones to avoid

How to escape hidden fees and advisor traps

Why annuities are critical for securing lifetime income in retirement

Innovative strategies to ensure you never outlive your money

Includes the ebook and professional audio of the book

Optional Upgrade #2 - The Complete Retirement Power Pack

Mastering Retirement Bundle + Annuity Blackbook + Roth Conversion Ebook for Only $67 (Save BIG when bundled!)

Ready to go all-in on protecting and maximizing your retirement? This complete bundle combines our two most popular upgrades with a brand-new, high-impact guide:

Ready to go all-in on protecting and maximizing your retirement? This complete bundle combines our two most popular upgrades with a brand-new, high-impact guide:

Mastering Retirement Course & Workbook – Your foundation for confident retirement planning.

The Annuity Blackbook – Exposes the hidden truths, fees, and strategies advisors don’t want you to know.

Roth Conversion Strategy Guide – Discover how a Roth conversion could potentially save you hundreds of thousands in retirement taxes. Learn when to convert, how to avoid costly mistakes, and how to build tax-free income for life.

Together, these resources give you a complete 360° strategy toolkit to protect your money, optimize your income streams, and unlock powerful tax-free growth opportunities. Includes ebooks and audio versions so you can learn your way.

👉 Upgrade now for just $67 and future-proof your retirement plan with the complete all-in bundle.

A Personal Letter From Caleb the Nurse:

“The Hospital Isn’t Going to Give Me Financial Freedom — So I Had to Build My Own Plan.”

Dear Fellow Nurse,

I want to tell you something I wish someone would’ve told me years ago — before the burnout, before the endless overtime, before the financial anxiety that kept me awake after night shifts:

The hospital is not going to get you to financial freedom.

No matter how loyal you are.

No matter how hard you work.

No matter how many shifts you pick up.

I didn’t learn that in a book.

I learned it the hard way.

My Story: The Truth I Had to Fight My Way Into

When I graduated as a brand-new nurse, I had the worst combination possible:

No experience.

No connections.

No BSN.

Just an ADN, a hotdog cart, a cargo van, and a newborn at home.

The job market was brutal. Nobody wanted to hire an associate-degree new grad in California. I submitted hundreds of online applications and heard nothing. Not a single call back.

My dad — a lifelong salesman — looked me in the eye and said:

“Caleb… you’re applying for jobs, but you’re not trying to get hired. Get in your van and go shake hands.”

So that’s what I did.

I drove hospital to hospital in that giant cargo van, wearing a power suit, sweating through it at times, introducing myself to nurse managers who probably thought I was insane.

I cold-called hospitals across the country — from San Jose all the way to Rockford, Illinois — because I refused to give up.

Eventually, someone said yes. A recruiter in Rockford took a chance on me. I packed up my family, moved across the country, and started my career.

I thought the hard part was over.

I was wrong.

The Reality Hit Me Faster Than I Expected

When I graduated as a brand-new nurse, I had the worst combination possible:

No experience.

No connections.

No BSN.

Just an ADN, a hotdog cart, a cargo van, and a newborn at home.

The job market was brutal. Nobody wanted to hire an associate-degree new grad in California. I submitted hundreds of online applications and heard nothing. Not a single call back.

My dad — a lifelong salesman — looked me in the eye and said:

“Caleb… you’re applying for jobs, but you’re not trying to get hired. Get in your van and go shake hands.”

So that’s what I did.

I drove hospital to hospital in that giant cargo van, wearing a power suit, sweating through it at times, introducing myself to nurse managers who probably thought I was insane.

I cold-called hospitals across the country — from San Jose all the way to Rockford, Illinois — because I refused to give up.

Eventually, someone said yes. A recruiter in Rockford took a chance on me. I packed up my family, moved across the country, and started my career.

I thought the hard part was over.

I was wrong.

The Turning Point: Learning What Nobody Teaches Nurses

I started studying.

Not clinical stuff.

Not certifications.

Not CEUs.

FINANCE.

Retirement planning.

Taxes.

Long-term care.

Social Security.

Income planning.

Market risk.

Nurse-specific retirement strategies.

And what I learned made me angry — because it explained exactly why nurses struggle:

Nurses were never taught ANY of this.

Not in school.

Not in orientation.

Not by HR.

Not by our hospitals.

No wonder we feel behind.

No wonder we feel confused.

No wonder so many of us say, “I’ll retire someday,” but inside we don’t believe it.

So I did what nurses always do when something is broken:

I built something to fix it.

Why I Wrote the Mastering Retirement Course (Nurse Edition)

I wrote this course — this system — because I wanted ONE thing:

A simple, calm, realistic retirement plan built for the real-life exhaustion, shift-work, and chaos of nursing.

Not a textbook.

Not Wall Street jargon.

Not another complicated spreadsheet.

Just a clear, step-by-step roadmap that answers the real questions we have:

How much do I actually need to retire?

When should I take Social Security?

How do I protect my savings from market crashes?

How do taxes work once I stop working?

Can I retire at 55? Even if I’m behind?

What if I’ve made mistakes? What if I started late?

I created this because I needed this.

And I know thousands of nurses need it too — because we have all been trying to piece it together alone.

If You’re Reading This… You Deserve Better

You deserve rest.

You deserve security.

You deserve a plan that isn’t built on overtime.

You deserve a future that doesn’t depend on how long your back, your knees, or your patience can hold out.

We spend our lives caring for others.

This is the moment you learn to care for your own future.

If you’re tired of guessing…

Tired of feeling behind…

Tired of feeling like your retirement depends on “hoping things work out”…

Then I made this for you.

What You'll Learn in The "Mastering Retirement" Course - Nurse Edition

Why traditional retirement advice fails nurses — and the simple shift that finally puts you in control of your financial future.

How the PRA (Personal Retirement Account) works — in plain English, with real nurse examples.

The Protect–Grow–Access™ framework — the 3-part system nurses use to build long-term stability without market losses.

How to retire by 55 (or sooner) — even if you started late or feel behind right now.

Exactly how much YOU need to save — the formulas and illustrations to plan your path clearly.

The hidden tax traps nurses fall into — and how to build tax-free income in retirement.

Why overtime is not a wealth strategy — and the simple monthly habit that builds 6–7 figure assets.

How to build a calm, predictable plan that doesn’t depend on luck, the stock market, or picking up extra shifts.

The most common nurse retirement mistakes — and how to avoid them starting today.

How nurses use PRA loans strategically — so your money grows even while you use it.

You’ll walk away with complete confidence knowing you finally have a real plan built for your career, your schedule, and your life.

Master The 8 Strategic Pillars Affluent Retirees Use to Coordinate Taxes, Income, Healthcare & Legacy

Navigate the Financial Landscape Like a Pro: Discover the hidden risks and opportunities within today's market

Master the Art of Strategic Retirement Planning: Learn the secrets to balancing growth and stability for long-term financial security

Crack the Code on Retirement Taxes: Minimize your tax burden and keep more of your hard-earned money

Safeguard Your Retirement with the Right Insurance: Protect your income, health, and legacy

Don't Miss Critical Retirement Milestones: Learn the key ages and decisions that can make or break your financial future

Master the Art of Cash Flow Management: Create a steady income stream that lasts a lifetime

Unlock Smart Investment Strategies: Explore annuities, indexed accounts, and other powerful tools for retirement growth and security

Leave a Lasting Legacy: Craft a financial plan that reflects your values and supports your loved ones for generations

FREE Bonus - The Pre-Retirement Checklist

The 11-Step Retirement Checklist You Can’t Afford to Miss

Most pre-retirees miss a few critical steps that quietly undermine their retirement — but this checklist helps ensure you’re not one of them. Built on the proven 8 Retirement Pillars framework, it reveals the 11 must-complete actions every future retiree should take to align their finances, lifestyle, and legacy. It’s not available anywhere else — you can only access this tool as a free bonus inside the Mastering Retirement course. If you want total clarity before you retire, don’t wait. Enroll now and get instant access to the checklist that’s helped countless others retire with confidence and control.

Your Future Is Worth One Decision

If you’re:

Just starting

Behind

Burnt out

or worried about the future…

This system will meet you where you are and give you a clear, calm path forward.

You'll be able to book your Millionaire Nurse Prescription Review on the Next Page

Pellentesque habitant morbi tristique

Maecenas ultricies aliquam viverra. Aliquam est massa

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec ut turpis nisi. Vestibulum hendrerit, dui ut mattis"

INFLUENCER NAME,

COMPANY

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec ut turpis nisi. Vestibulum hendrerit, dui ut mattis"

INFLUENCER NAME,

COMPANY

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec ut turpis nisi. Vestibulum hendrerit, dui ut mattis"

INFLUENCER NAME,

COMPANY

Don't Love It - Don't Pay Guarantee

The "Don't love it - don't pay guarantee"

If unsatisfied with the course, request a refund and keep the physical and digital versions. You'll receive a full refund – no questions asked!

Don't wait for the next financial crisis to wipe out your dreams. Take control of your future TODAY.

Take this course, and you'll be armed with the knowledge and strategies you need to navigate the market like a seasoned pro. You'll sleep better at night, knowing your retirement is rock-solid. And you'll finally be able to relax and enjoy the fruits of your labor, without the constant worry of financial ruin.

Remember, the clock is ticking.

Everyday you wait is a day closer to the next market downturn. Don't gamble with your future.

Secure your retirement, and start living the life you deserve.

Mastering Retirement Course – FAQs

Quick answers about pricing, what's included, access, shipping, guarantees, and upgrades.

How much does the course cost?

What’s included in the $27 bundle?

- A 94-page printed copy of Mastering Retirement (shipped to you)

- Digital versions (EPUB, Apple, Kindle, MOBI)

- The full professionally narrated audiobook

- A 34-page printed workbook to create your retirement plan

- BONUS: The Pre-Retirement Checklist (11 steps most people miss)

Are there any subscription charges or recurring payments?

Do I have to pay extra for shipping?

How long does it take to receive the printed book and workbook?

Do I get instant access to the digital materials?

What if I don’t like the course?

Is this course only for people with $250K+ in assets?

Do I need a financial advisor to use this course?

Can I buy this for someone else?

What devices can I use to read the ebook?

Will this course replace financial advice?

Is there an upgrade available?

Who created the course?

Mastering Retirement Course – FAQs

Quick answers about pricing, what's included, access, shipping, guarantees, and upgrades.

How much does the course cost?

What’s included in the $27 bundle?

- A 94-page printed copy of Mastering Retirement (shipped to you)

- Digital versions (EPUB, Apple, Kindle, MOBI)

- The full professionally narrated audiobook

- A 34-page printed workbook to create your retirement plan

- BONUS: The Pre-Retirement Checklist (11 steps most people miss)

Are there any subscription charges or recurring payments?

Do I have to pay extra for shipping?

How long does it take to receive the printed book and workbook?

Do I get instant access to the digital materials?

What if I don’t like the course?

Is this course only for people with $250K+ in assets?

Do I need a financial advisor to use this course?

Can I buy this for someone else?

What devices can I use to read the ebook?

Will this course replace financial advice?

Is there an upgrade available?

Who created the course?

Have Questions? Email us at [email protected]

Copyright © 2025 FCBI, LLC All Rights Reserved.